Feb 4, 2025

Financial Market Analysis: How Mexico and Canada Surrendered to Trump – What It Means for Investors

In a pivotal moment in the global financial landscape, the recent actions of Mexico and Canada in response to U.S. tariffs have sent shockwaves through the financial market analysis community. This blog will dissect these developments, their implications for investors, and the broader economic impact, particularly in light of China's potential reactions.

Introduction to the Current Financial Climate

As we navigate through the complexities of today's financial landscape, the implications of geopolitical tensions and trade policies are becoming increasingly pronounced. The recent developments surrounding U.S. tariffs have not only reshaped the dynamics between Mexico, Canada, and the United States but also sent ripples across global markets. Investors are left to assess the fallout from these decisions, particularly in the context of a recovering economy. The financial market analysis is crucial for understanding the potential trajectories of investments in the coming months.

Key Indicators of Economic Health

In recent weeks, key economic indicators have shown signs of resilience. Consumer spending has rebounded, and manufacturing activity is on the rise. However, these positive signals are juxtaposed against the backdrop of escalating trade tensions. Investors must remain vigilant as these conflicting forces could lead to volatility in the stock market.

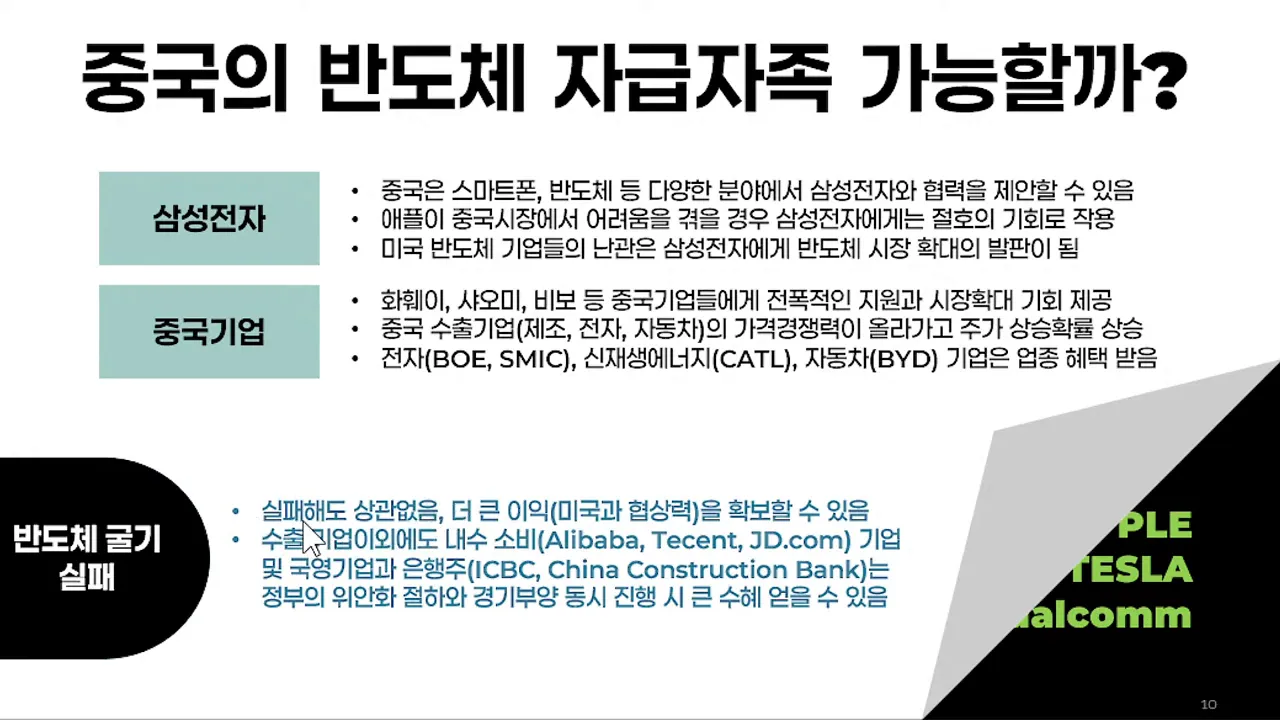

The Role of Semiconductors

The semiconductor industry, a vital component of the global economy, is particularly impacted by these trade dynamics. With companies like Samsung Electronics actively navigating supply chain challenges and tariff implications, the future of this sector hangs in the balance. The recovery of semiconductor demand is crucial for tech giants and their investors alike.

Trump's Tariff Bombshell: A Game Changer

President Trump's recent tariff policies have been described as a "bombshell" in the economic arena. The immediate effect was a stark reaction from both Mexico and Canada, who swiftly announced their compliance with U.S. demands. This rapid concession raises questions about the long-term implications for North American trade relations and the broader economic landscape.

Immediate Market Impact

The announcement of tariffs led to a significant sell-off in the stock market, with investors reacting to the uncertainty. However, the swift compliance from Mexico and Canada triggered a surprising turnaround, with a surge in buying activity. This paradoxical response highlights the unpredictable nature of market reactions to geopolitical events.

Immediate Market Reactions: A Surge Amidst Surrender

Markets initially plummeted following the tariff announcements, reflecting investor anxiety over potential economic fallout. Yet, as news broke of Mexico's and Canada's concessions, a notable recovery began. This phenomenon illustrates the complex interplay between policy decisions and market sentiment.

Investor Sentiment and Market Dynamics

Investor sentiment shifted dramatically, as the market interpreted these concessions as a step towards stabilization. The Dow Jones and NASDAQ saw significant rebounds, fueled by renewed optimism. This underscores the importance of understanding market psychology in the face of rapidly changing political landscapes.

Mexico's Compliance: An Overview of the Terms

Mexico's swift compliance with U.S. tariffs has set a precedent for future negotiations. The terms outlined include increased border security measures and cooperation on drug trafficking. These concessions reflect Mexico's aim to mitigate the impact of tariffs on its economy while maintaining a favorable relationship with the U.S.

Details of the Agreement

- Deployment of additional security forces at the U.S.-Mexico border.

- Enhanced cooperation in combating drug trafficking and illegal immigration.

- Commitment to address U.S. concerns regarding trade imbalances.

Canada's Response: Strengthening Security Measures

Following Mexico's lead, Canada has also announced a series of measures to comply with U.S. demands. This includes a substantial budget allocation for border security and the establishment of a task force focused on drug-related issues.

Canada's Strategic Moves

- Investment of $1.8 billion in border security initiatives.

- Appointment of a "Fentanyl Czar" to oversee drug enforcement efforts.

- Designation of drug trafficking as a national security issue.

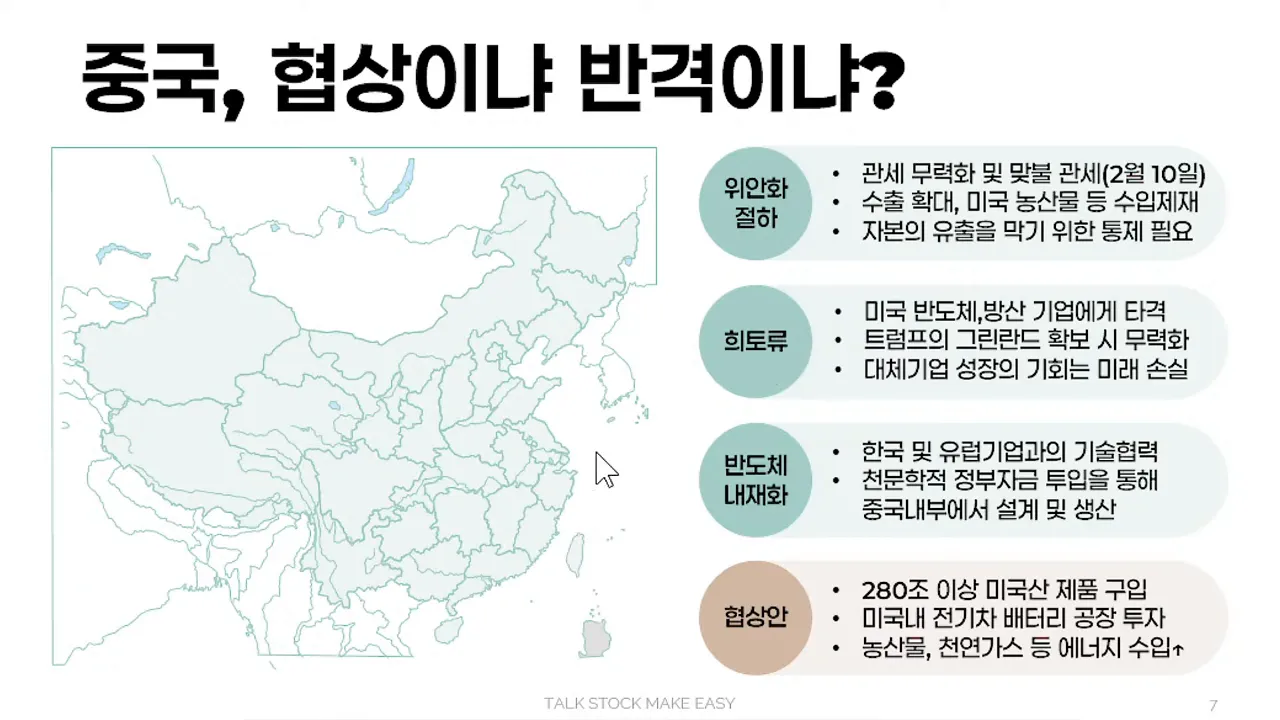

China's Potential Strategy: Cooperation or Conflict?

As the geopolitical landscape evolves, China's strategy in response to U.S. tariffs and global economic pressures is becoming increasingly critical. Investors are left to ponder whether China will lean towards cooperation with the West or resort to conflict. The delicate balance between these two approaches will significantly influence market dynamics and investment opportunities.

China's past experiences with economic sanctions and tariffs have shaped its current strategies. The government is expected to implement stringent measures to control capital outflows while simultaneously boosting domestic investments. This dual approach aims to stabilize the economy and ensure that funds remain within the country to strengthen local enterprises.

Strategic Economic Measures

- Implementing strict capital controls to prevent asset flight.

- Announcing large-scale economic stimulus packages to invigorate domestic markets.

- Enhancing support for key industries, particularly in technology and manufacturing.

This strategy could lead to a short-term surge in domestic stock markets as investors react positively to government support. However, the long-term implications of these measures must be carefully monitored, as they may lead to increased tensions with the U.S. and its allies.

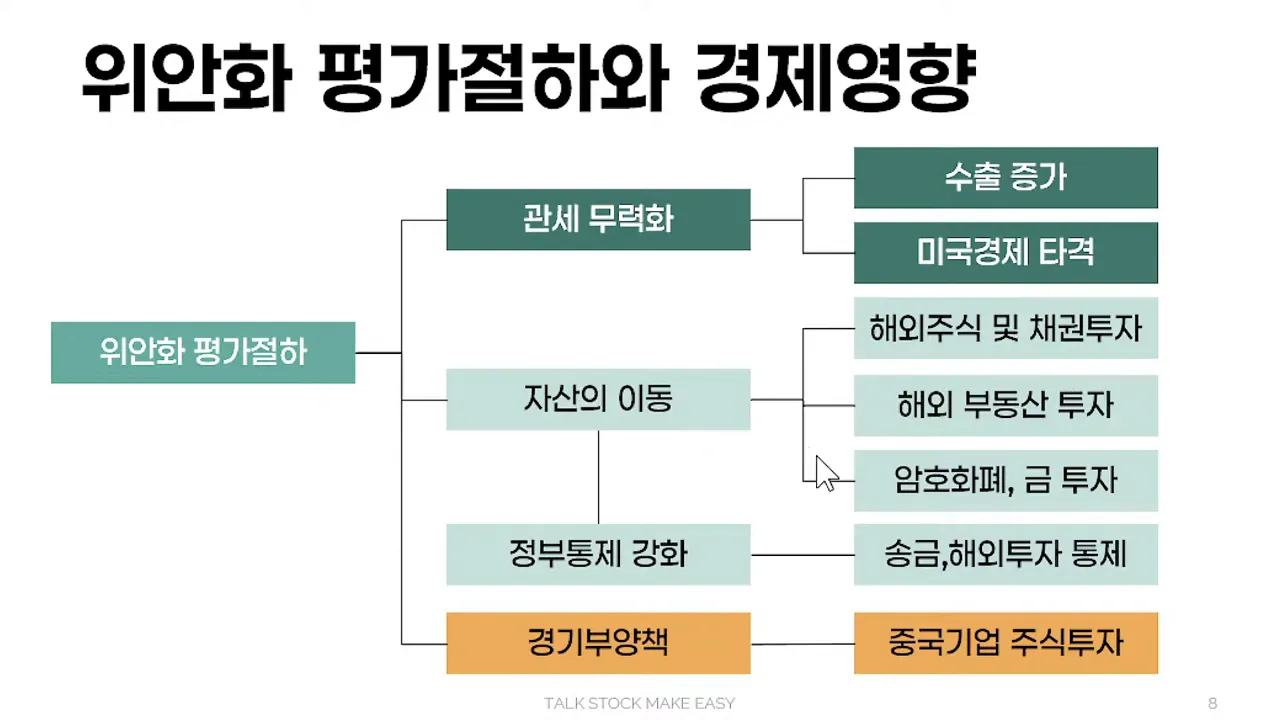

The Impact of Currency Devaluation: What Investors Should Know

Currency devaluation is a powerful tool that China may employ to counteract U.S. tariffs. By lowering the value of the yuan, Chinese exports become cheaper, potentially offsetting the impact of tariffs. This tactic, while beneficial for Chinese exporters, can have widespread repercussions across global markets.

Investors should be aware that a devalued yuan could lead to increased volatility in currency markets, impacting not only Chinese stocks but also those of companies reliant on Chinese supply chains.

Potential Market Reactions

- Increased volatility in foreign exchange markets.

- Pressure on commodity prices as demand fluctuates.

- Opportunities for investors in undervalued markets.

While a weaker yuan can stimulate exports, it may also provoke retaliatory measures from the U.S., leading to an escalation in trade tensions. Investors need to remain vigilant and adapt their strategies accordingly.

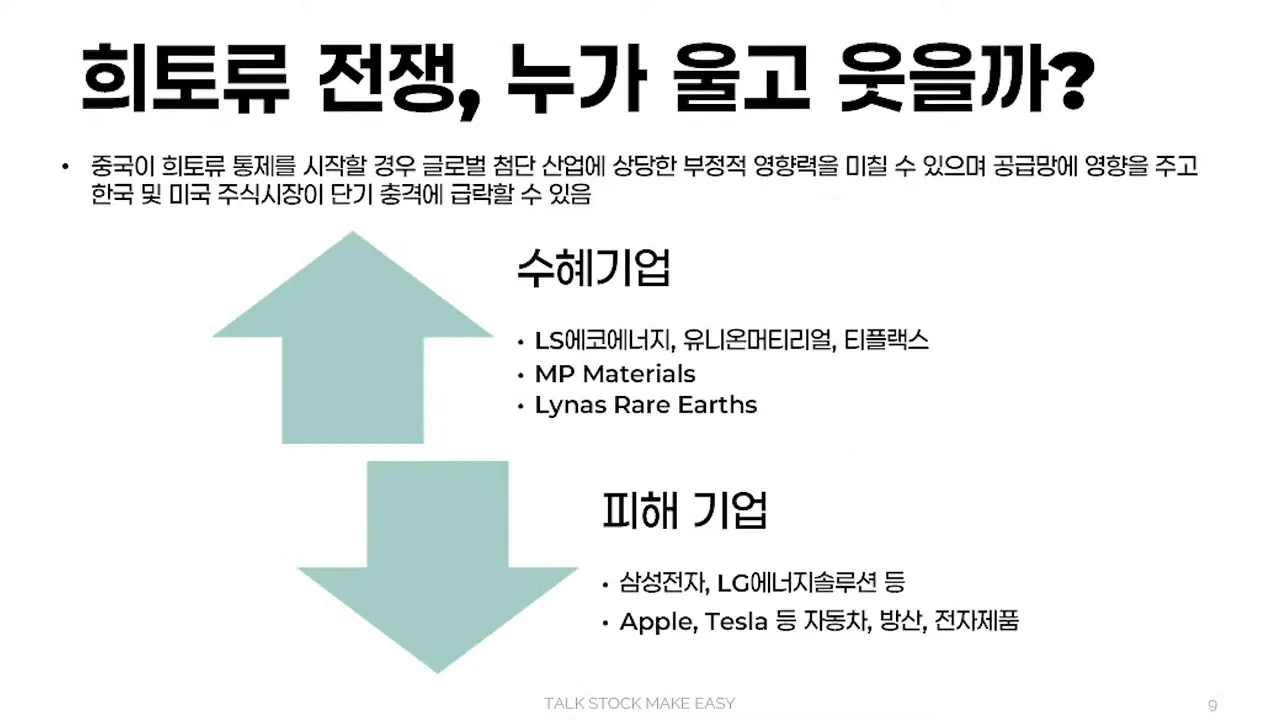

Rare Earth Elements: A Strategic Weapon in the Trade War

China's dominance in the production of rare earth elements (REEs) positions it as a key player in the ongoing trade war. These materials are essential for various high-tech applications, including electronics, renewable energy technologies, and military equipment. As tensions rise, China may utilize its control over REEs as leverage in negotiations.

The potential for China to restrict the export of these materials could lead to significant disruptions in global supply chains, particularly for companies in the U.S. and allied nations.

Implications for Global Industries

- Increased costs for industries reliant on REEs.

- Potential shifts in supply chains as companies seek alternative sources.

- Opportunities for investment in companies focused on REE alternatives.

Investors should consider the implications of China's rare earth strategies and explore opportunities within companies that can adapt to these changes. The race for alternative materials could open new avenues for growth in the market.

The Future of Semiconductor Self-Sufficiency in China

China's ambition for semiconductor self-sufficiency is a cornerstone of its economic strategy. The ongoing trade war has highlighted vulnerabilities in China's reliance on foreign technology, particularly from the U.S. As a result, the Chinese government is investing heavily in domestic semiconductor production.

However, achieving self-sufficiency in this critical sector is a formidable challenge. The U.S. continues to hold significant technological advantages, which may hinder China's efforts.

Challenges and Opportunities

- Significant investment required to develop domestic capabilities.

- Potential for partnerships with non-U.S. firms to access advanced technologies.

- Market opportunities for investors in emerging semiconductor firms.

While the path to self-sufficiency is fraught with challenges, it also presents unique investment opportunities for those willing to navigate the complexities of the semiconductor landscape.

Conclusion: Preparing for Market Volatility

As geopolitical tensions continue to evolve, investors must prepare for potential market volatility. The interplay between U.S.-China relations, currency fluctuations, and the strategic importance of rare earth elements and semiconductors will shape the investment landscape.

Staying informed and agile will be key for investors looking to capitalize on emerging opportunities while mitigating risks. By understanding the broader economic implications of these developments, investors can position themselves effectively for the future.